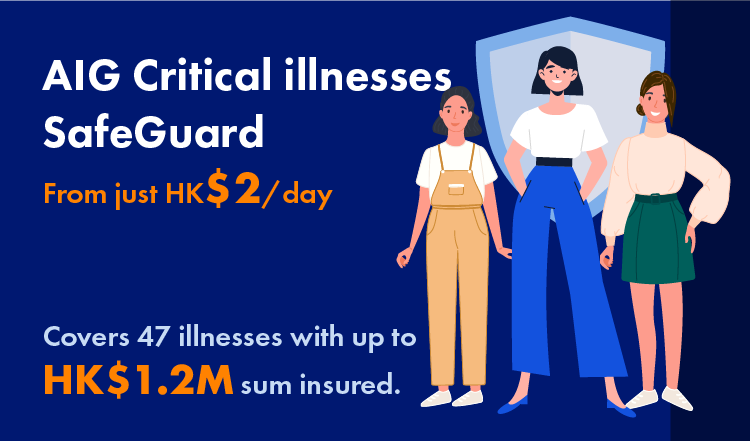

AIG Critical Illness SafeGuard

| Benefit item | Basic Plan | Standard Plan | Prestige Plan |

|---|---|---|---|

| Max. Coverage (HK$) | |||

| Core Critical Illness Benefit | $600,000 | $800,000 | $800,000 |

| Extra Cash for Specific Major Cancers | N/A | $400,000 | $400,000 |

| Free Included Cover | |||

| Household Bills Protection (Monthly cash during hospitalization, up to 6 months) | N/A | $6,000 / month | $10,000 / month |

| Daily Hospital Cash Benefit | N/A | N/A | $500 / day |

| Extra Hospital Cash Benefit for Intensive Care Unit | N/A | N/A | $500 / day |

| Optional Family Protection | |||

| Core Critical Illness Benefit (for children) | $90,000 | $120,000 | $120,000 |

| Juvenile Specific Illness Cover | $300,000 | $400,000 | $400,000 |

| Children Education Fund | N/A | $10,000 | $15,000 |

| Benefit item | Basic Plan | Standard Plan | Prestige Plan |

|---|---|---|---|

| Max. Coverage (HK$) | |||

| Core Critical Illness Benefit | $600,000 | $800,000 | $800,000 |

| Extra Cash for Specific Major Cancers | N/A | $400,000 | $400,000 |

| Free Included Cover | |||

| Household Bills Protection (Monthly cash during hospitalization, up to 6 months) | N/A | $6,000 / month | $10,000 / month |

| Daily Hospital Cash Benefit | N/A | N/A | $500 / day |

| Extra Hospital Cash Benefit for Intensive Care Unit | N/A | N/A | $500 / day |

| Optional Family Protection | |||

| Core Critical Illness Benefit (for children) | $90,000 | $120,000 | $120,000 |

| Juvenile Specific Illness Cover | $300,000 | $400,000 | $400,000 |

| Children Education Fund | N/A | $10,000 | $15,000 |

No medical check-up required

Complete online application in 5 minutes

Instant approval

Start your protection as soon as the next day

Anyone aged 18 to 65 can apply AIG Critical Illness SafeGuard and renew the policy up to age 75.

Waiting period for AIG Critical Illness SafeGuard is 90 days. AIG shall not pay any claim in which any critical illness which first manifested and was diagnosed within the waiting period.

Unfortunately, CIS is not covered under AIG Critical Illness SafeGuard.

The cost of each Critical Illness SafeGuard insurance plan will vary depending on your age at application or renewal, gender, family medical history, personal medical history, etc.

The plan covers at least 47 different critical illnesses, including 3 major critical illnesses including major cancer, heart attack (of specified severity) and stroke (with permanent neurological deficit), end stage kidney failure, and 44 other common illnesses. Please refer to our full list of coverage here.